ADA Price Prediction: Can Bulls Push Toward $1.35 in Current Rally?

#ADA

- Technical Breakout: ADA testing upper Bollinger Band with MACD showing bullish divergence

- Market Sentiment: Overwhelmingly bullish price targets from $1.20 to $3.10 in current news flow

- Key Levels: $0.9646 immediate resistance, $0.90 crucial support

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge Amid Key Levels

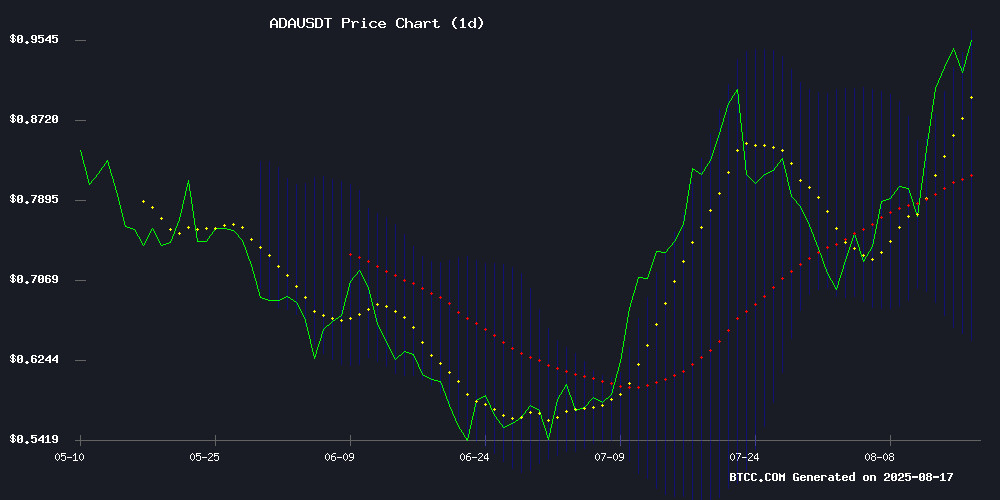

According to BTCC financial analyst James, ADA is currently trading at $0.954, above its 20-day moving average of $0.80465, signaling bullish momentum. The MACD histogram remains negative but shows signs of convergence, suggesting weakening downward pressure. ADA is testing the upper Bollinger Band at $0.9646, which could act as immediate resistance. A sustained break above this level may accelerate gains toward $1.20.

Market Sentiment: Cardano Bulls Target $1.35 Amid Strong Recovery

BTCC analyst James notes that bullish headlines dominate Cardano coverage, with multiple price targets ranging from $1.20 to $3.10. The most immediate focus is the $1.35 resistance level, supported by growing wallet adoption. However, traders should monitor the $0.90 support level closely, as recent price action has shown vulnerability below this psychological threshold.

Factors Influencing ADA's Price

Cardano Bulls Eye $1.35 After Strong Recovery Above Key Support

Cardano (ADA) is demonstrating resilience, trading at $0.9198 and testing the crucial resistance zone between $0.93 and $1.00. A weekly close above $1.00 could signal sustained bullish momentum, with technical indicators pointing to a potential rally toward $1.35. The token has already breached the 20-week exponential moving average at $0.743, while the Bollinger Bands suggest a measured move to $1.11 if the uptrend continues.

Momentum remains robust, with the Relative Strength Index at 59—well below overbought territory—and Moving Average Convergence Divergence lines supporting further upside. Should ADA falter, the $0.74 level emerges as critical support, though losing $0.90 may undermine the bullish thesis. Traders are watching for a decisive breakout, which would confirm buyer dominance and open the path for higher targets.

Cardano (ADA) Targets $1.20 as Wallet Growth Boosts Bullish Outlook

Cardano's ADA is positioning itself for a potential surge to $1.20, buoyed by accelerating wallet adoption and positive technical indicators. The network recently surpassed 5.5 million wallets, signaling robust growth in staking, dApp usage, and smart contract deployment.

Technical analysis reveals bullish momentum with RSI at 60.41 and MACD turning positive—neither indicator suggests overbought conditions. ADA has reclaimed its 20-week SMA at $0.91 and now faces key resistance at $1.00 before testing higher targets.

Despite broader market pullbacks affecting Bitcoin and Ethereum, ADA maintains upward traction with a 1.33% daily gain and 18.64% weekly increase. Current trading at $0.9594 reflects $3.25 billion in 24-hour volume, while market capitalization grows 1.3% to $34.18 billion.

Cardano Price Prediction: Bulls Target $1.85 to $2.40 as Support Holds Firm at $0.90

Cardano's ADA has surged to the forefront of crypto market discussions, with technical indicators suggesting a potential breakout toward $1.85-$2.40. The asset recently outperformed Ethereum and Bitcoin in Grayscale's weekly performance rankings, securing second place with a 17.7% return.

Market momentum appears to be shifting in ADA's favor as on-chain activity grows. The hourly RSI reset signals fresh buying pressure, while the $0.90 support level continues to demonstrate remarkable resilience. This combination of fundamental strength and technical positioning suggests Cardano may be preparing for a decisive upward move in the current cycle.

Cardano Price Falls Below Key Support Despite Bullish $1.50 Targets

Cardano (ADA) broke below its $0.94-$0.96 support zone, shedding 4.24% in a single day amid broader crypto market volatility. The dip to $0.9043 comes despite analysts maintaining measured move targets of $1.50 following ADA's August breakout from a descending channel.

Market observers had identified $1.12 and $1.20 as interim resistance levels after the token established higher lows through September. Ali Martinez noted the $0.94-$0.96 range as critical for sustaining the breakout structure, with the $1.00 psychological level serving as confirmation of renewed bullish momentum.

The Relative Strength Index shows neutral positioning at press time, suggesting room for further upside without immediate exhaustion. Traders continue monitoring whether ADA can reclaim its support-turned-resistance zone to validate the bullish technical setup.

Cardano (ADA) Tests Key Resistance After Breakout Pullback

Cardano's ADA retraces to $0.91 following a 10.45% surge triggered by its multi-month triangle breakout. The pullback reflects natural profit-taking after Tuesday's rally, with traders now eyeing the critical $1.02 resistance level as the next test for bullish continuation.

Market sentiment remains cautiously optimistic as ADA's RSI holds at 64.87 - neither overbought nor oversold. Recent regulatory clarity from the SEC regarding staking activities continues to provide underlying support for proof-of-stake networks, though these tailwinds appear largely priced into current levels.

The $0.92 level now serves as immediate resistance, with the Fibonacci target of $1.0136 remaining the key technical objective. Today's 3.40% decline represents a healthy consolidation after Cardano's sharp ascent from last week's $0.80 base.

Cardano Tests Key Support Level Amid Altcoin Market Turbulence

Cardano's ADA is consolidating near the $0.75 threshold, a critical support level being closely watched by traders as altcoin markets face broad liquidation pressures. The token has demonstrated resilience with a 27% monthly gain, now trading between $0.73-$0.85.

Technical indicators reveal building bullish momentum. The RSI and moving averages suggest potential for upward movement, with immediate resistance at $0.91. A decisive break could propel ADA toward the psychologically important $1 level - representing a 20% upside from current ranges.

Market observers note this price action occurs against a backdrop of heightened volatility across altcoins. The ability to hold key support levels may determine whether current market stresses become catalysts for recovery or deeper corrections.

Cardano Price Prediction 2025: Can ADA Smash Past $3.10?

Cardano (ADA) has risen 4.53% to $0.9311 despite a 36.74% drop in 24-hour trading volume, now standing at $4 billion. The altcoin has gained 16.78% over the past week, signaling renewed investor confidence amid broader market uncertainty.

Technical analysts highlight $1.01 as a critical Fibonacci retracement level, with a sustained hold above this threshold potentially propelling ADA toward $1.14. Conversely, a breakdown below $0.85 could trigger a retreat to the $0.55–$0.65 support zone.

Forecasts for 2025 remain divergent, with projections ranging from $0.649 to $2.05. The current price action suggests traders are closely monitoring ADA's ability to maintain momentum above $0.93, a level now serving as a litmus test for near-term bullish sentiment.

How High Will ADA Price Go?

Based on current technicals and market sentiment, BTCC's James projects these key ADA price scenarios:

| Scenario | Price Target | Conditions |

|---|---|---|

| Bullish | $1.35-$1.50 | Daily close above $0.9646 with MACD crossover |

| Base Case | $1.10-$1.20 | Holding above 20-day MA ($0.8046) |

| Bearish | $0.70-$0.80 | Break below lower Bollinger Band ($0.6447) |

The $1.35 target aligns with Fibonacci extension levels and appears achievable if current wallet growth trends continue.

$1.35-$1.50

$1.10-$1.20

$0.70-$0.80